AI Voice Agent for Business Financing

Julian answers every call from businesses seeking capital—guiding them through pre-qualification questions and booking follow-up calls with your advisors, all without human delay.

Get startedJulian the Phone Agent

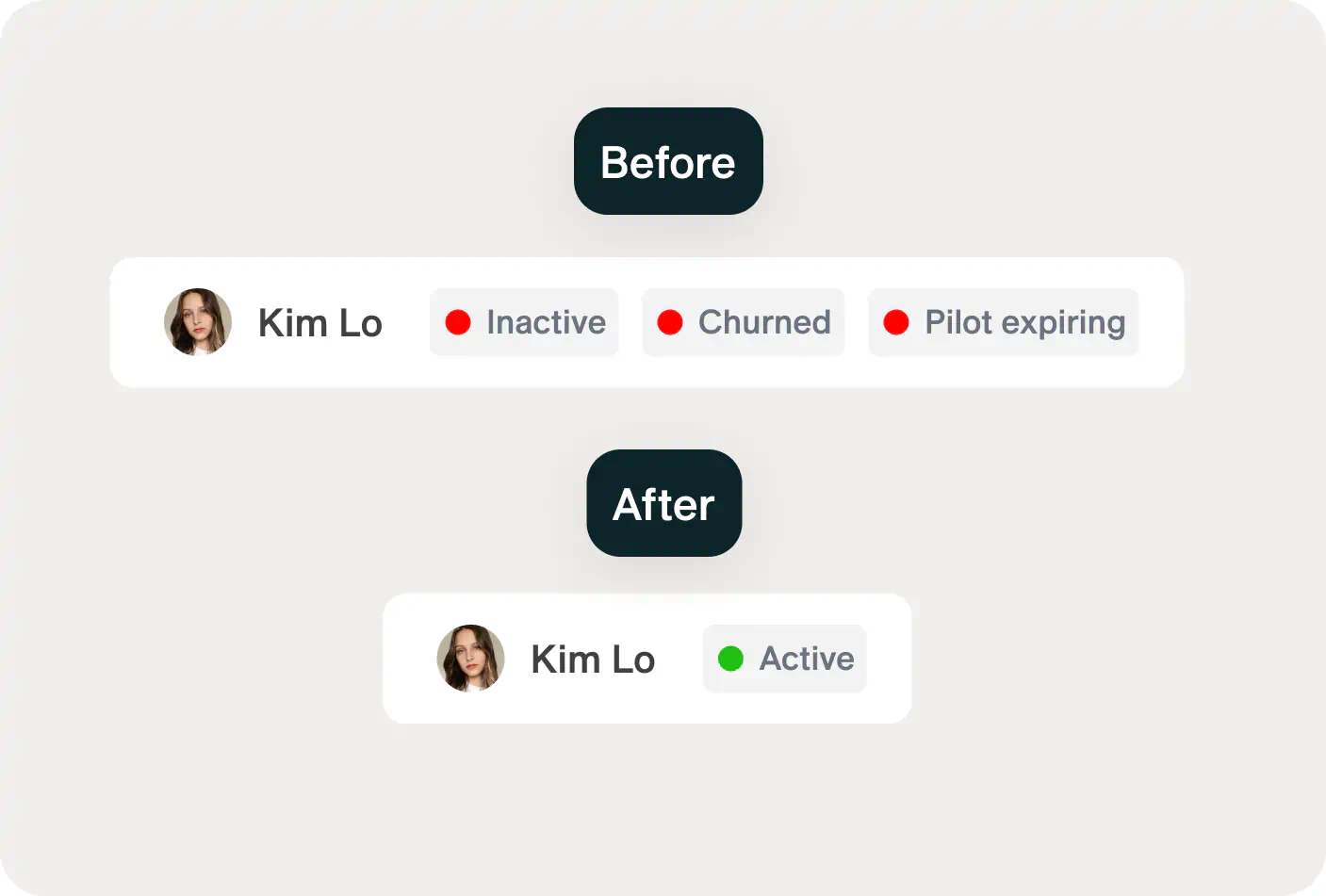

Active