AI Loan Intake Specialist

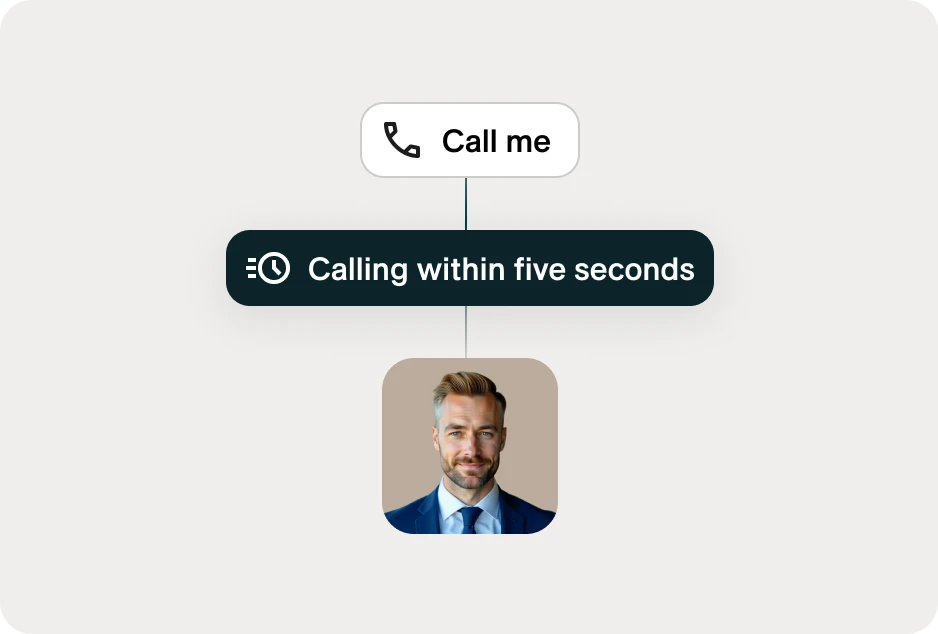

Julian is your digital loan intake specialist—capturing inbound interest from small business owners, qualifying applicants instantly, and handing off high-intent borrowers to your financing team.

Get startedJulian the Phone Agent

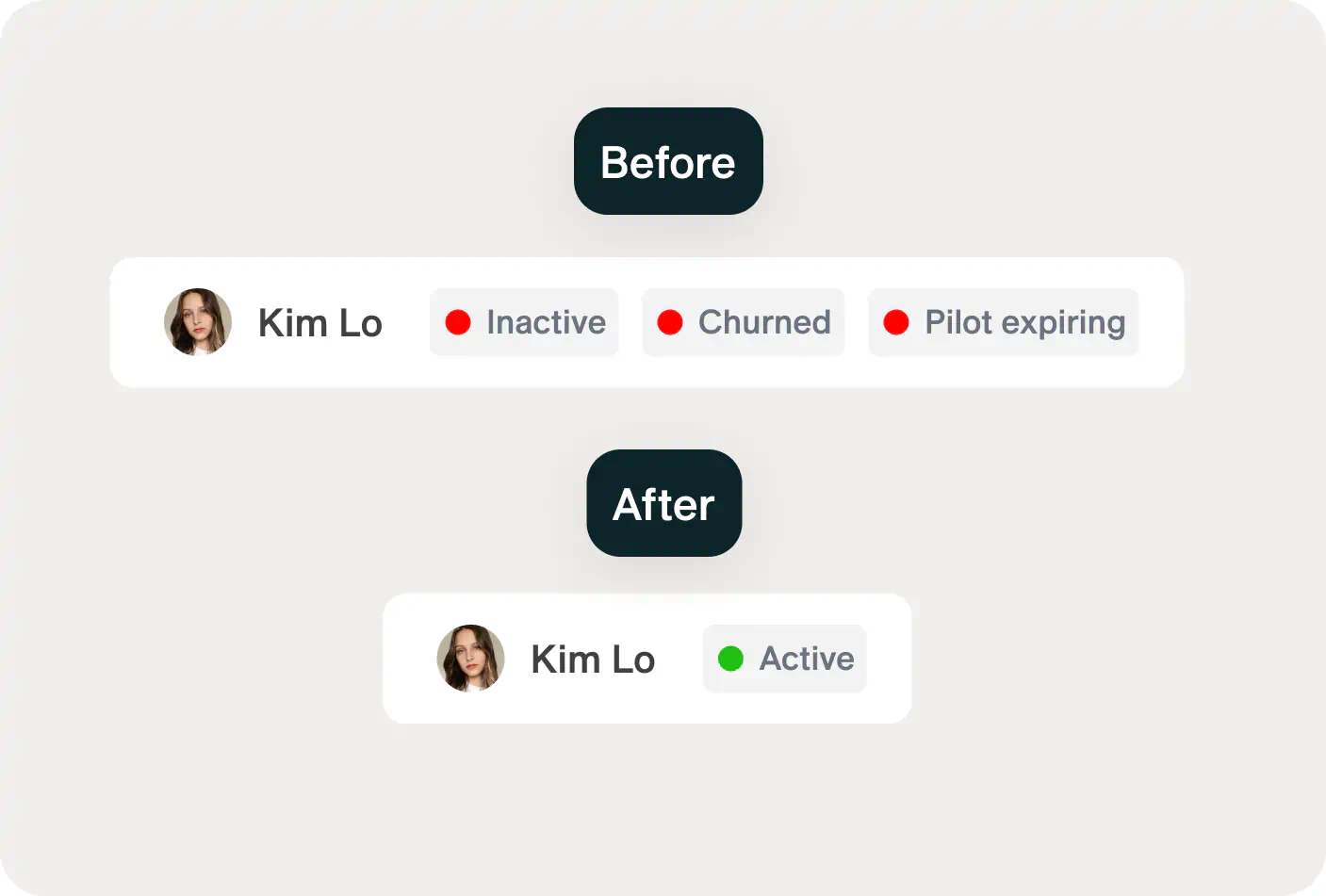

Active